Achieving PCI-DSS Compliance with Ontelio™ Redaction Solutions

In today's digital landscape, protecting cardholder data is paramount for businesses handling payment card information. The Payment Card Industry Data Security Standard (PCI-DSS) outlines comprehensive security measures to ensure this protection. Ontelio’s advanced redaction solutions provide critical support in achieving PCI-DSS compliance by automating the secure handling and redaction of sensitive cardholder data.

Understanding PCI-DSS Compliance

PCI-DSS compliance is essential for any organization that processes, stores, or transmits credit card information. The standard consists of 12 requirements organized into six control objectives designed to protect cardholder data and maintain a secure environment:

- Build and maintain a secure network and systems.

- Protect cardholder data.

- Maintain a vulnerability management program.

- Implement strong access control measures.

- Regularly monitor and test networks.

- Maintain an information security policy.

Ontelio's Role in PCI-DSS Compliance

Protecting Cardholder Data

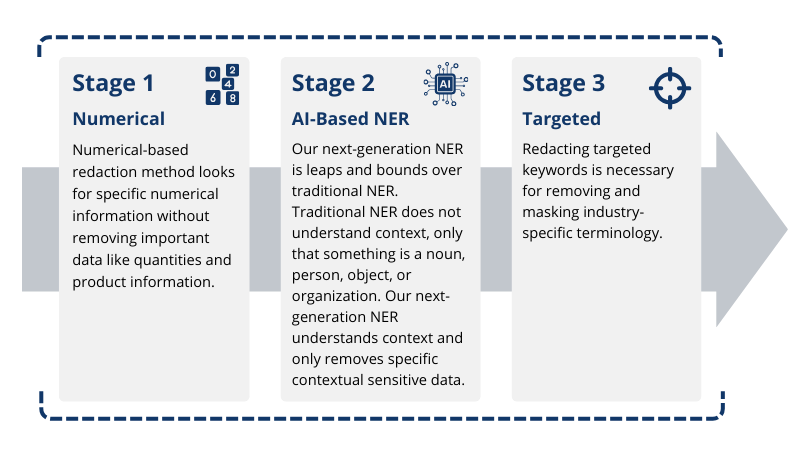

Ontelio’s proprietary multi-stage redaction engine is specifically designed to identify and redact cardholder data from various communication channels, such as call recordings, transcripts, and chat logs. This aligns with PCI-DSS requirements to protect stored cardholder data (Requirement 3) and encrypt transmission of cardholder data across open, public networks (Requirement 4).

Strong Access Control Measures

Ontelio’s redaction solutions support PCI-DSS requirements for strong access control measures (Requirement 7-9) by ensuring that sensitive cardholder data is redacted before being stored or accessed. This minimizes the risk of unauthorized access to sensitive information, thereby protecting cardholder data from potential breaches.

Vulnerability Management and Secure Systems

By automating the redaction process, Ontelio reduces the risk of human error and enhances the overall security posture of the organization. This supports PCI-DSS requirements for maintaining a vulnerability management program (Requirement 6) and securing systems and applications (Requirement 5).

Regular Monitoring and Testing

Ontelio’s solutions facilitate regular monitoring and testing (Requirement 11) by providing a secure and compliant way to handle and store sensitive cardholder data. Automated redaction ensures that logs, recordings, and transcripts do not contain unredacted cardholder data, making it easier to maintain compliance during audits and assessments.

Comprehensive Security Policies

Ontelio helps organizations develop and maintain comprehensive security policies (Requirement 12) by integrating redaction practices into their information security frameworks. This ensures a consistent approach to handling and protecting cardholder data across the entire organization.

Industry Specific Redaction Solutions

Ontelio offers customizable solutions tailored to the specific needs of various industries, ensuring comprehensive compliance with SOC2 across different operational contexts:

Retail: Automates the redaction of cardholder data during point-of-sale transactions and customer service interactions.

E-commerce: Protects cardholder data during online transactions and customer support chats.

Finance: Ensures secure handling of payment card information in financial transactions and communications.

Customer Implementation

An E-commerce company that processes a high volume of credit card transactions daily. Ontelio’s redaction engine automatically scans and redacts cardholder data from call recordings and chat transcripts, ensuring that no unredacted sensitive information is stored or accessed. This not only protects cardholder data but also streamlines compliance efforts, reducing the burden on IT and compliance teams.

Summary

Ontelio’s AI-driven redaction solutions offer a robust and efficient approach to achieving PCI-DSS compliance. By automating the redaction of sensitive cardholder data and ensuring secure handling across all communication channels, Ontelio helps organizations meet PCI-DSS requirements, enhance data security, and protect against data breaches. This proactive approach to data protection fosters trust with customers and regulatory bodies, ensuring a secure and compliant operational environment.